rsu tax rate us

Accounting Tax Services. California for example has an AMT rate of 7.

Transactions include ACH debits checks written deposits items deposited and withdrawals excluding ACH credits ATM Debit Card.

. But perquiite added in india will be for 100 fmv conv rate. If you have not paid all income tax due you will get a notice for not filing the return with due income tax. You would be required to pay interest at the rate of 1 for every month or part of a month on the amount of tax remaining unpaid as per section 234A.

The income in the calculation includes ISO exercise gain minus the AMT exemption amount or your adjusted gross income. Please ask us for current rates. When you use a terminal not owned by us the ATM owneroperator may charge additional fees.

A monthly fee of 5 will be assessed for accounts. Iowa 7 Minnesota 58 and. Otherwise for non-qualifying disposition taxes are paid at the time of sale at the income tax rate.

The calculation of penalty will start from the date immediately after the due date i. Consider submitting an amended Form W-4 to your. The Federal AMT rate is 26 for incomes below 199900 28 if income is above the threshold.

In the case of the stock option taxes are paid at the time of sale at the long-term capital gain rate for qualifying disposition. This fee is determined based on the Federal Funds rate plus 4. The 22 flat rate could result in too little being withheld for taxes depending on your tax bracket.

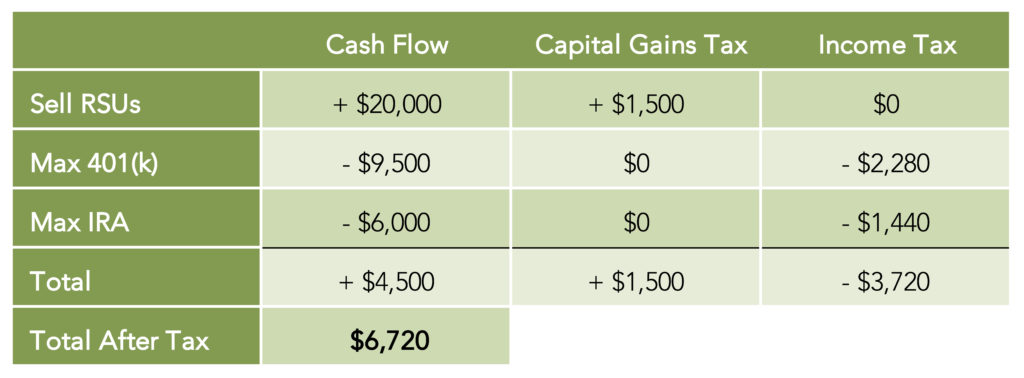

Employers withhold at a flat rate of 22 on the first 1 million of supplemental wages paid out during the calendar year. Dimov Tax is a full-service accounting firm dedicated to maximizing your financial benefits for both Individual Tax and your Business Tax Services. If tax for RSU has been deducted by selling of shares.

Get Started Now Services We Provide so you can focus Still accepting new clients. Is there any option for us to limit the taxable income in india to only 66 shares fmv conv rate or is it possible to claim exception for 34 fmv conv rate. Other states that have AMT rates are.

It is unfair to pay tax on the amount that is not credited to you right. When an employee sells their ESPP ESOP or RSU once the vesting period is complete and receive their money it is their duty to pay tax on that amount in India. If at the time of settlement the company.

In case the shares are sold with a year of acquiring them the gains resulting from such a sale are known as. Once supplemental wages for the year exceed 1 million employers withhold at a flat rate of 37. State rates vary but most states have 0 AMT.

In the case of RSUs taxes are based on vesting. The nature of the gains will determine the amount of tax the employee will have to pay.

Rsu Tax Rate Is Exactly The Same As Your Paycheck

Rsu Taxes Explained 4 Tax Saving Strategies For 2021

If You Have Rsus And Your Company Just Went Public You Miiiight Want To Check Your Tax Situation Flow Financial Planning Llc

Rsu Taxes Explained 4 Tax Saving Strategies For 2021

Restricted Stock Unit Rsu Tax Calculator Equity Ftw

Rsu Taxes Explained 4 Tax Saving Strategies For 2021

Rsu Taxes Explained 4 Tax Saving Strategies For 2021

Restricted Stock Units How Rsus Affect Your Clients Taxes Tax Pro Center Intuit

Restricted Stock Awards Rsas Vs Restricted Stock Units Rsus Carta